2024 Fourth Quarter Oil & Gas Energy Survey

Companies cautiously optimistic for future production and employment

by Federal Reserve Bank of Kansas

January 10, 2025

KANSAS CITY, MISSOURI - The Kansas City Fedís quarterly Tenth District Energy Survey provides information on current and expected activity among energy firms in the Tenth District. The survey monitors oil and gas-related firms located and/or headquartered in the Tenth District, with results based on total firm activity. Survey results reveal changes in several indicators of energy activity, including drilling, capital spending, and employment. Firms also indicate projections for oil and gas prices. All results are diffusion indexes Ė the percentage of firms indicating increases minus the percentage of firms indicating decreases.

Results of this survey can be found here: 2024 Fourth Quarter Energy Survey (7 pages, 356K). Results from past surveys and release dates for future surveys can be found at www.kansascityfed.org/.

The Federal Reserve Bank of Kansas City serves the Tenth Federal Reserve District, encompassing the western third of Missouri; all of Kansas, Colorado, Nebraska, Oklahoma and Wyoming; and the northern half of New Mexico. As part of the nationís central bank, the Bank participates in setting national monetary policy, supervising and regulating numerous commercial banks and bank holding companies, and providing financial services to depository institutions.

Firms were contacted between December 16th, 2024, and January 2nd, 2025. Here are some of the survey findings:

- Firms reported that oil prices needed to be on average $62 per barrel for drilling to be profitable, and $84 per barrel for a substantial increase in drilling to occur. Natural gas prices needed to be $3.69 per million Btu for drilling to be profitable on average, and $4.66 per million Btu for drilling to increase substantially.

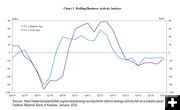

- The quarter-over-quarter drilling and business activity index was in Q4 was unchanged from the previous quarter. Drilling activity remained down from this time last year. Annual revenues decreased substantially, however, employment and capital expenditures grew moderately.

- Employment and employee hours continued to increase even as revenues and profits declined further.

- Firms anticipate a rebound in activity in the next six months, however, revenues and profits are still expected to decline further in the coming months.

- Firms reported what they expected oil and natural gas prices to be in six months, one year, two years, and five years. The average expected WTI prices were $70, $71, $75, and $81 per barrel, respectively. The average expected Henry Hub natural gas prices were $3.09, $3.36, $3.67, and $3.98 per million Btu, respectively.

- Firms were asked about their plans for employment and capital expenditures in 2025 vs. 2024. Most firms plan to keep employment levels mostly unchanged or increase them slightly. Another 10% of firms plan to increase employment significantly, and only 7% plan to decrease employment slightly. Plans for capital expenditures were more mixed. Many firms plan to increase capital expenditures slightly (43%), while 17% plan to increase them significantly, 13% remain unchanged, 17%, decrease slightly, and 10% decrease significantly.

Source: https://www.kansascityfed.org/surveys/energy-survey/tenth-district-energy-activity-fell-at-a-steady-pace/ www.kansascityfed.org

|